Amendment to Advance Income Tax Rate

Amendment to Advance Income Tax Rates

- Introduction

- New Rates of Advance Income Tax

- Request for Action

- Conclusion

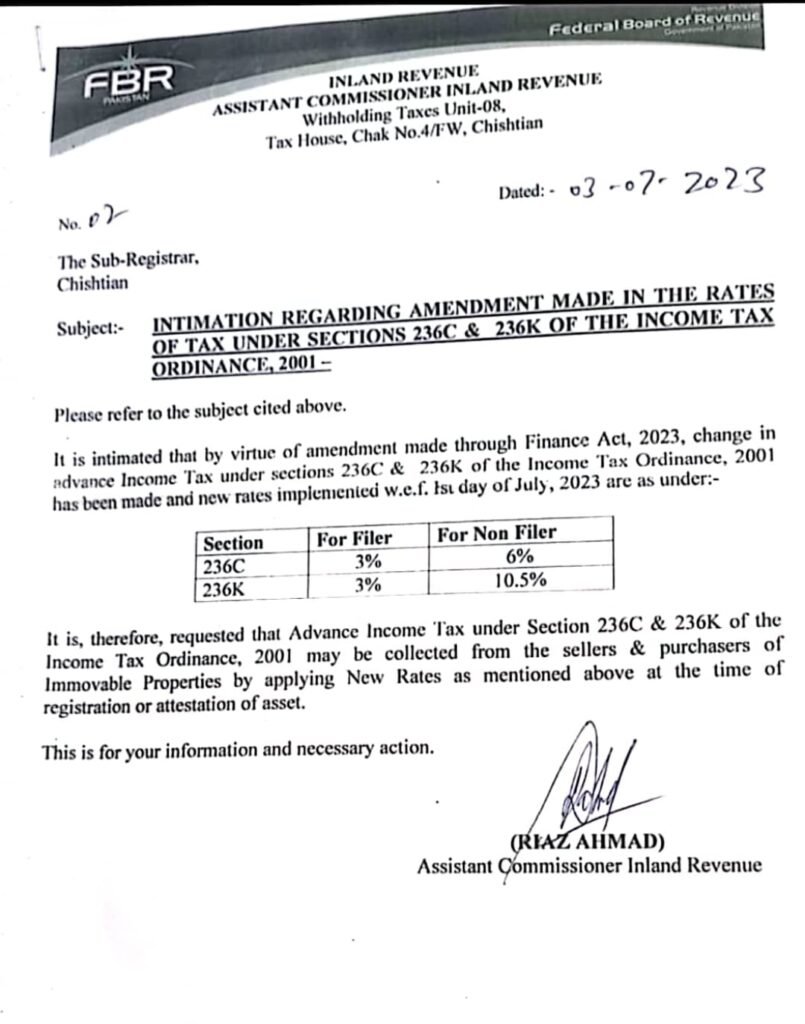

Introduction

This letter is to inform you of an amendment to the rates of advance income tax under sections 236C and 236K of the Income Tax Ordinance, 2001. The new rates, which will be effective from July 1, 2023, are as follows:

- For filers: 3% for both sections 236C and 236K

- For non-filers: 6% for section 236C and 10.5% for section 236K

New Rates of Advance Income Tax

The new rates of advance income tax apply to the following transactions:

- Sale of immovable property

- Attestation of immovable property

Request for Action

I request that you take the necessary steps to ensure that the new rates of advance income tax are applied when collecting advance income tax from sellers and purchasers of immovable properties.

Conclusion

Thank you for your cooperation.

Sincerely,

Riaz Ahmad Assistant Commissioner Inland Revenue

اب کوئی بھائی زمین سیل کرے یا خریدے ٹیکس دونوں ہی دیں گے اور بھی اب 20.6٪ تک پہنچ چکا ہے

Leave a Reply